Juan Mozos Nieto

Connect with me using the links below:

LinkedIn

Resume

GitHub

Email

About Me

Hello! I’m Juan Mozos Nieto, nice to meet you!

I’m a senior from Spain, set to graduate in December 2023 from Lehigh University, pursuing a double major in Finance and Business Analytics, complemented by a minor in Financial Technology (FinTech). My primary focus lies in the realms of finance, technology and data. I am especially interested in how technological innovations or data solutions are adopted and leveraged to improve efficiency. Additionally I’m particularly drawn to the intersection of finance and sustainability, with a keen interest in renewable energy.

My academic journey reflects this passion, as I explore how technological innovations and data, can enhance efficiency and contribute to making more informed business decisions. Beyond traditional finance courses, I’ve delved into financial data analytics and blockchain applications, showcasing my commitment to understanding the evolving landscape of finance and its role in environmental stewardship. I believe that staying informed about emerging trends and advancements in the field is essential for a successful career in finance, which is why I remain committed to keeping up with the latest developments in the industry.

Portfolio

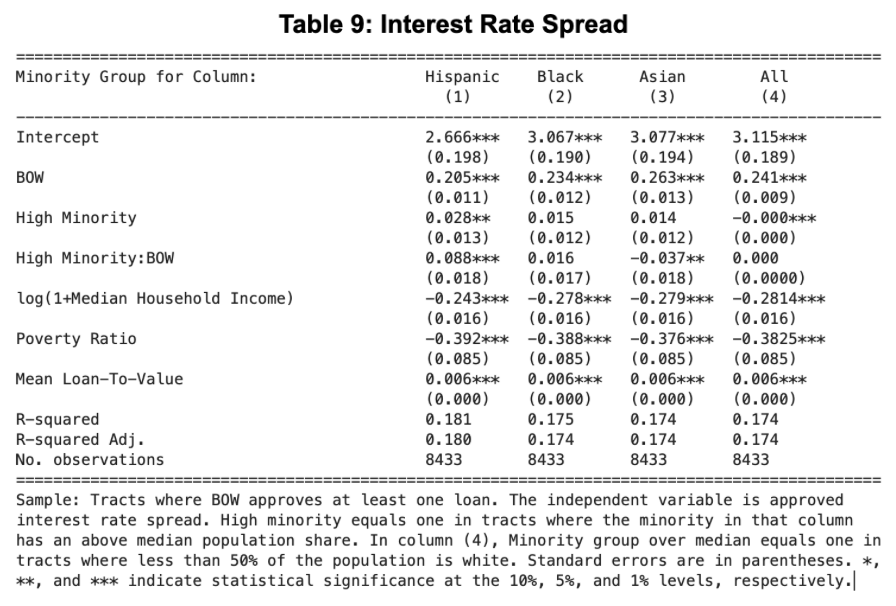

Analyzing Bank of the West Lending Practices

Government regulations today prevent financial institutions from making lending decisions based on an applicant’s demographic attributes. Historically, the practice of redlining prevented residents of certain areas from accessing credit due to race or ethnicity. Our mission on this project was to identify whether or not Bank of the West violates fair lending requirements by conducting a thorough analysis of its lending behaviors in areas with high minority populations. To see the full report, our analysis, methodologies and findings please see the project’s website.

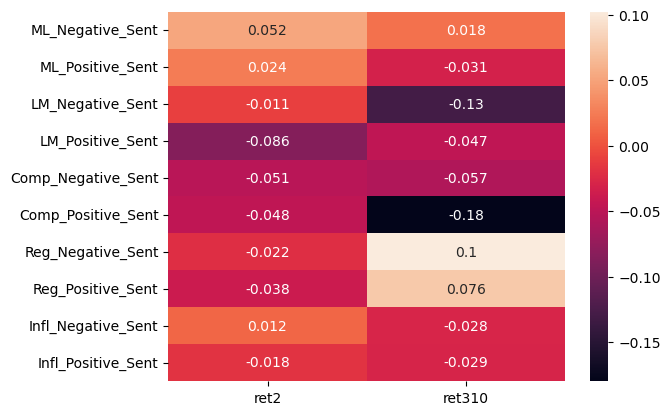

Analyzing the correlation between 10-K sentiment scores and post-filing stock returns

The purpose of this project is to analyze the relationship between the performance of stocks for firms in the S&P500 index and the sentiment of their respective 10-K filings. Two different post 10-K release return variables are computed and their relationship against various sentiment variables pertaining to 10-K data is analyzed. A hypothesis on the expected correlations between these variables is first formulated, and after some analysis I end up contradicting my initial hypothesis. Shortly put, the more negative the sentiment scores the better the firm’s stock performance is. For further details about the purpose of the project, the data being used, and the process of data creation please refer to the link above.

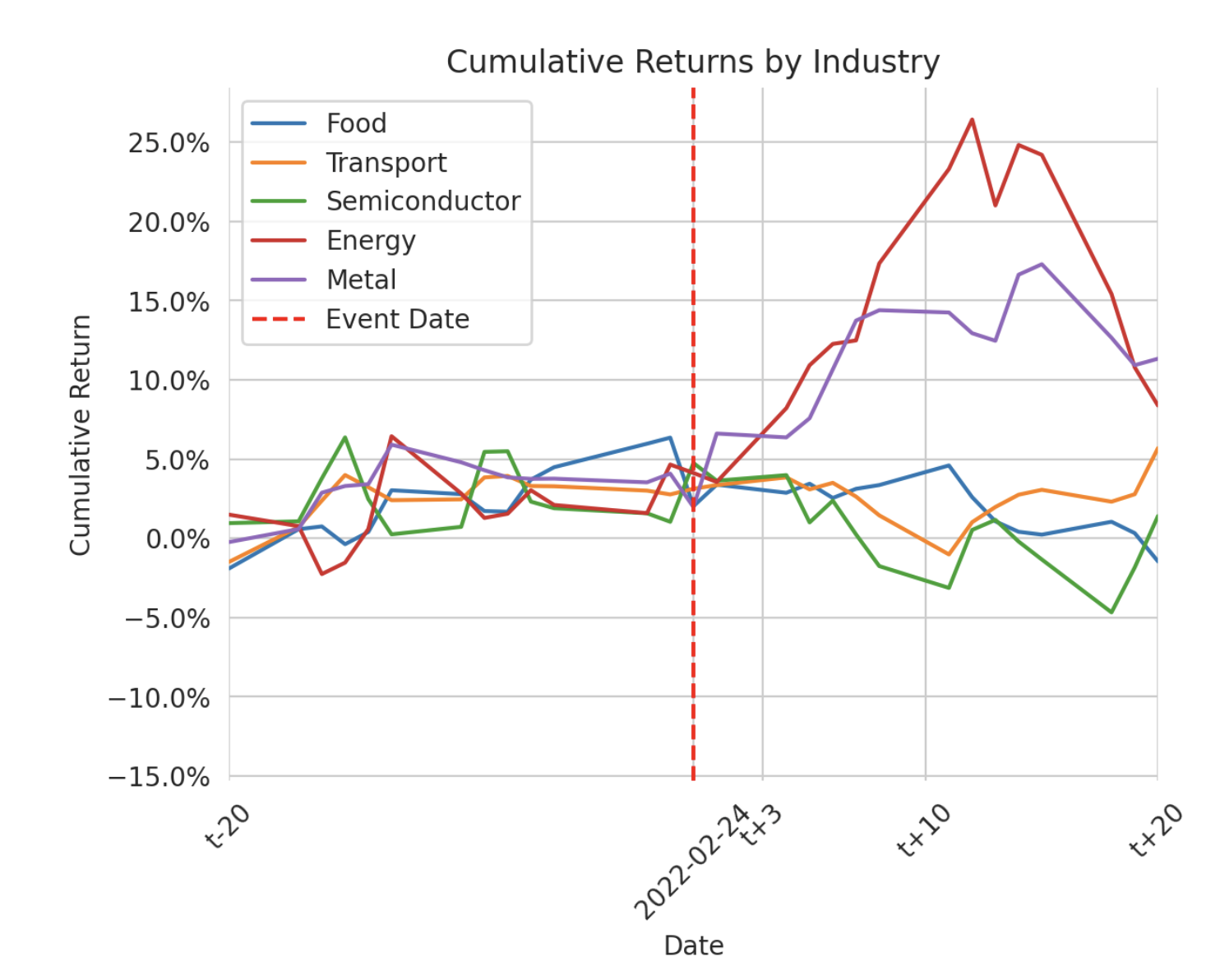

The main goal of this project is to explore how different industries are affected by the Russian-Ukrainian armed conflict that started on the 24th of February of 2022. In order to do so, we analyzed how different industries’ returns were affected by a number of major events throughout the course of the war. We used a total of 17 major events and saw how cumulative returns for 5 industries, namely metal, energy, semiconductors, food, and transport industries, changed. In order to perform our analysis we used line-plots and computed return differences between the event date, 3 days after the event and 10 days after the event.

To see and interact with the visualizations we based our analysis on, please visit the home page of our dashboard. This page will allow you to select a number industries at a time (or all of them) and events based on their description which will then output a line graph based on the desired industry and event choices.

For further details on the data we used to produce the visualization, the methodologies used to produce the code that produces the visualizations, our findings and the conclusions we reached please visit our dashboard’s report section.

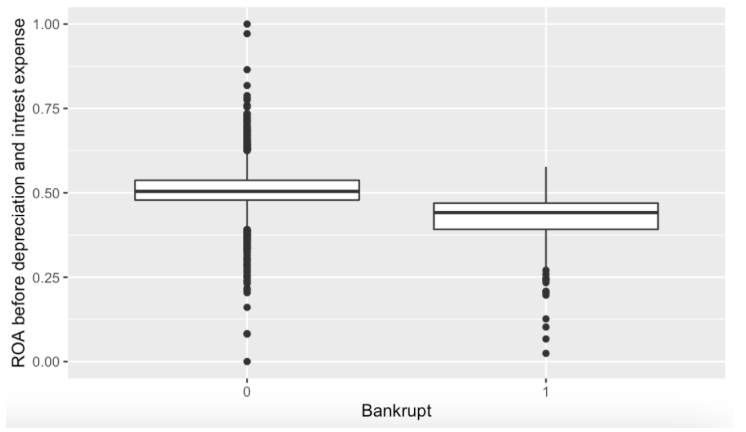

Bankruptcy Prediction for Taiwanese Companies

The purpose of this project was to use ML (Machine Learning) techniques, such as multiple linear regression or classificaction and regression trees (CART), to predict the probability of a given company going bankrupt. In order to do so, we used their financial data and were able to discover which are the most significant indicators of bankruptcy probability. For further details on the methodology, process, and data used please visit the link of the report above.

FIN336 (Real Estate Finance) Data Analytics Project

Career Objectives

My career objective is to pursue a career in the Finance industry, with a particular focus on private equity, venture capital, and startups. I am drawn to these sectors because they are typically involved in the development of technological innovations, which is one of my key interests. My goal is to be a part of a team that identifies and invests in companies with high potential for growth and success. In the short term, I am looking for internships for the summer of 2023 to gain practical experience and further develop my skills in these areas. If you are interested in learning more about my qualifications, please visit my LinkedIn and resume links.

Hobbies

My hobbies are playing and watching soccer (Atletico de Madrid fan), skiing, and spending quality time with friends and family

Page template forked from evanca